On Monday morning, Swiss local time, Nestlé headquarters in the peaceful town of Vevey started a busy day as usual. What is unusual is that a group of special visitors came here.

At about 8: 00 in the morning, FOODINC came to the Nestlé headquarters building to have a breakfast with Mark Schneider on invitation. The 53-year-old CEO of Nestlé, the world's largest food company, looked energetic in a black suit and white shirt. He walked slowly into the dining hall and shook hands with us, the friends coming from afar.

I bet Mark Schneider is no stranger to the regular readers of FOODINC, and Schneider himself is also quite familiar with the Chinese market. During the breakfast, our talk on the Chinese market began with his latest impression on China. At present, China is Nestlé's second largest market in the world, next only to the United States.

“When I used to work in other companies, even from the early 1990s, I came to China regularly.” Schneider told FOODINC that he was deeply impressed by the development of Chinese market over the years. “I am talking about not only the data performance such as GDP, but also the fact that China's market and Chinese consumers have been at the forefront in more and more aspects and provide valuable reference for other markets around the world."

Interestingly but not surprisingly, Schneider mentioned the example of mobile payment in China. "When I visited China in the past few years, I was particularly surprised by one thing: as a foreign consumer, I found I could hardly pay for anything when I went out shopping," he told FOODIC.

“Because merchants want neither cash nor credit card payment, they don't like the big discounts generated in the credit card transactions. As for Alipay, WeChat payment and some other mobile payment systems, you must have a bank account in China before you can use them." Schneider smiled helplessly, saying that when he wanted to buy something in China last time, he had to ask someone else to pay for him, “because I couldn't pay although I wanted to".

However, he believed that this is a sign of progress. “China's cashless payment has penetrated into daily transactions, which in my opinion signifies the future." Schneider told FOODIC that this also provides a huge opportunity for data mining, giving enterprises the chances to better predict and analyze consumer behavior and better serve consumers than ever before.

Speaking of expectations for the taste and quality of Chinese consumers, Schneider believed that the Chinese consumers have always been pursuing good food and good ingredients, which Nestlé has already realized.

Later, Schneider specifically mentioned “Nestlé for Healthier Kids", which aims to help 50 million children around the world lead a healthier life by 2030 by continuously reducing sugar and salt, increasing vegetables, vitamins and minerals, and providing nutrition knowledge and recipes.

According to a report released by Nestlé this week, the Company has reduced 40,000 tons of sugar and 6,200 tons of saturated fat since 2014; reduced more than 15,000 tons of salt since 2012; increased the number of micronutrient fortified foods to 174 billion and made 99.8 % of its product portfolio free from trans fatty acids (TFA) in 2017.

Nestlé has become more focused in its businesses while making its product portfolio “more nutritious and healthier".

Last year, Schneider announced his “policy agenda" shortly after taking over as Nestlé CEO, saying that he would adjust the product portfolio that accounts for 10% of Nestlé’s sales and focus on four major businesses, namely coffee, pet food, infant nutrition and bottled water. In the year that follows, Nestlé frequently carried out a series of acquisitions and divestitures around its core strategic businesses.

“In China, how will you allocate resources in these four strategic core businesses? What are Nestlé's priorities?" FOODIC asked with curiosity.

Previously the Swiss food giant had said unequivocally that the Company would increasingly use its capital expenditure to promote the high-growth food and beverage products, especially the above four categories, in order to promote the overall growth of the Company.

Schneider first explained to FOODIC the intention of Nestlé's strategy.

“I noticed that there may be some misunderstanding about these four high-growth categories.” First of all, he said, the average organic growth rate of high-growth categories is almost twice that of other categories, so these high-growth categories are particularly important in boosting the organic growth of the Company.

“But we can't say that other categories are not important to us.” Schneider stressed, “Because if you want to invest in those high-growth categories, you need sufficient funds and resources. Perhaps the growth of other categories is not so fast, but they ensure that Nestlé has sufficient funds to invest in those high-growth categories.”

Therefore, he said, Nestlé is equally concerned about the entire product portfolio, but when it comes to high growth, Nestlé pays special attention to these four categories.

For China, among these four high-growth categories, Schneider believed coffee is a priority.

“Nestlé did very well in spreading coffee culture in other markets. Take Britain as an example. Until the 1970s, the British mainly drank tea. But now Britain has become a market dominated by coffee.” He said, “The explosive growth of the British coffee market does not just lies in coffee consumed at home, but in British coffee shops - the latest number, I think, is 20,000 - which also offers unprecedented opportunities for coffee consumption.”'

Schneider told FOODIC that Nestlé now sees great opportunities in the Chinese coffee market. “China's low per capita coffee consumption means that there are huge opportunities, and I think the consumer's interest is very high - the long queue in front of Starbucks Reserve Roastery in Shanghai shows that people have a deep interest in coffee products.”

Therefore, Schneider believed that Nestlé will develop all key coffee brands in China and offer products at different prices, including focusing on Nescafé, DOLCE GUSTO and Nespresso and cooperation with Starbucks.

Schneider realized that Chinese consumers are no longer satisfied with simply enjoying the products, especially coffee, but Nestlé still has a lot of work to do to sell coffee machines to Chinese consumers.

“Whether it's coffee capsules or roasted coffee beans, these do not work well for people who don't have coffee machines at home. If you want your products to be sold out, you must show everyone how the machine works, and you must also let everyone be willing to place such a machine in a small kitchen where space needs to be highly utilized. Therefore, consumer education needs to be carried out,” he said.

Schneider expected that the alliance with Starbucks will enable Nescafé to win more consumers in China. “Starbucks has more than 3,000 stores in China and is expanding at an average rate of opening a new store every 15 hours. Its growth momentum in China is very strong and people think it is a great brand.” Nestlé's role, he said, is to enable consumers to enjoy the same products at home.

“Because in addition to Starbucks' coffee sold in stores and Starbucks' ready-to-drink coffee, other Starbucks coffee products are sold by us, such as Starbucks' roasted coffee beans and coffee capsules which will be sold by Nestlé. As mentioned earlier, consumer education and sales work should be done well so that the consumers may know how to make a cup of good coffee. Everyone can make tea, but not everyone can make good coffee,” he said.

At the same time, Schneider believed that there is also great growth potential with the ready-to-drink coffee market. “One of the fastest growing categories of Nescafé in China is ready-to-drink coffee,” he revealed to FOODIC.

"It should be noted that Chinese consumers drink coffee in a very different way from European consumers, so ready-to-drink coffee is a very large category in China with a much larger scale than that in Europe." Traditionally, coffee drinks in Europe are usually small cups or slightly larger cups of espresso, black or white, sugar or sugar-free, sweet or not sweet as we call it today, Schneider explained.

At the same time, Schneider said that with the efforts of Starbucks and other companies, more traditional coffee consumption patterns are expected to be gradually seen in China in the future, and Nestlé will seize the opportunities and become a representative of the premium coffee brands in the Chinese market.

“You will see that we attach great importance to the coffee business. At present, I am satisfied with the progress made,” he said.

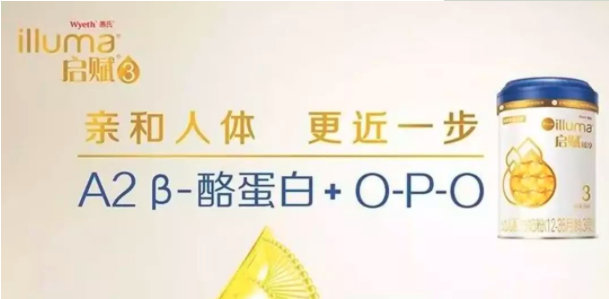

Wyeth Illuma launched the new A2 infant formula product in China this year

As for nutrition business, Schneider went on to say that Nestlé has occupied a leading position in China's infant formula market and is still very concerned about this business. FOODIC introduced last month that Nestlé's infant nutrition business is accelerating growth in China, and it is reported that 2018 Q3 recorded the strongest performance in the past three years.

Speaking of bottled water, Schneider told FOODIC that Nestlé China mainly focuses on developing its international high-end brands. “Like these placed on the table now (S. Pellegrino), they also sell well in China.”

Introduction to S. Pellegrino seen during the visit to Nestlé Demonstration Pavilion "Nest" in Switzerland

Finally, when talking about the pet food, Schneider said that the consumption level of pet food in China is relatively low at present because many Chinese families still feed their pets with leftovers. However, he expressed optimism about the growth trend: “The trend of pet food business in China will be the same as other emerging markets. With the increase of per capita income, the proportion of households consuming pet food will gradually increase.”

He believed that pet food saves time for family feeding and is also a better food choice for pets because they are specially made by mixing various ingredients required by the pets. "In these respects, pet food is a better solution and I have confidence in the growth of Nestlé China's pet food business.”

Nestlé Fancy Feast Pet Food

"So, in all the four categories, I see a good development prospect for Nestlé in the Chinese market," Schneider told FOODIC.

As for the development strategy in different cities in China, Schneider believed that in China, the opportunity for Nestlé's most products has lay in expansion in first-tier and second-tier cities. “With the passage of time, more and more sales and better and better performance will be achieved in the third and fourth tier cities in China. I think it's a good opportunity for Nestlé to focus on the third and fourth tier cities in the future," he said.